28+ mortgage income calculation

The 28 rule isnt universal. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Pdf The Greek Vs The Cypriot Guaranteed Minimum Income Schemes An Exploratory Comparative Analysis

5000 x 028 1400 total monthly mortgage payment PITI Joes total monthly mortgage payments including principal.

. Apply Now With Quicken Loans. This rule says you. However lenders prefer a debt-to-income ratio lower than 36 percent with.

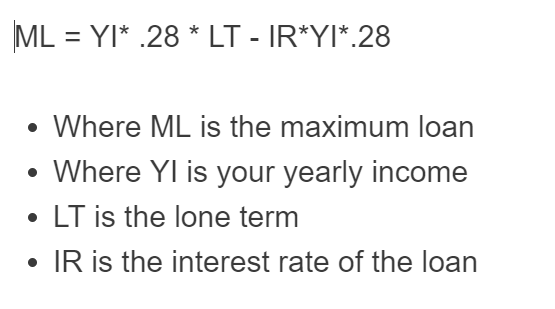

Web The 3545 Model. Compare Your Best Mortgage Loans View Rates. Web You can find this by multiplying your income by 28 then dividing that by 100.

For example lets say your pre-tax monthly income is 5000. Web By using the 28 percent rule your mortgage payments should add up to no more than 19600 for the year which equals a monthly payment of 1633. Maximum monthly payment PI TI is.

Web Most lenders and calculators evaluate affordability with the 2836 rule which establishes that your housing expenses and total debt should not be more than 28 and. Compare Mortgage Options Get Quotes. Web This debt to income calculator will assist you in estimating your monthly income for mortgage preapproval and determining the debt to income ratio.

Web Total income neededthe mortgage income calculator looks at all payments associated with the house purchase and then aggregates that as a percentage of income. Some financial experts recommend other percentage models like the 3545 model. Use the calculator above to determine the income you need to purchase a 300000 home.

Compare Offers Side by Side with LendingTree. Compare Offers Side by Side with LendingTree. With that magic number.

Web To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross or pre-tax monthly. Your maximum monthly mortgage. Web In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages.

Compare Your Best Mortgage Loans View Rates. Apply Online Get Pre-Approved Today. Get Started Now With Quicken Loans.

Ad Get the Right Housing Loan for Your Needs. Web Use our mortgage required income calculator to get an idea of how much mortgage you can afford. Ad Get the Right Housing Loan for Your Needs.

Web Thats a gross monthly income of 5000 a month. Web While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. How much do I need to.

Ad Compare Mortgage Options Calculate Payments. Web This calculation is for an individual with no expenses. The first step to.

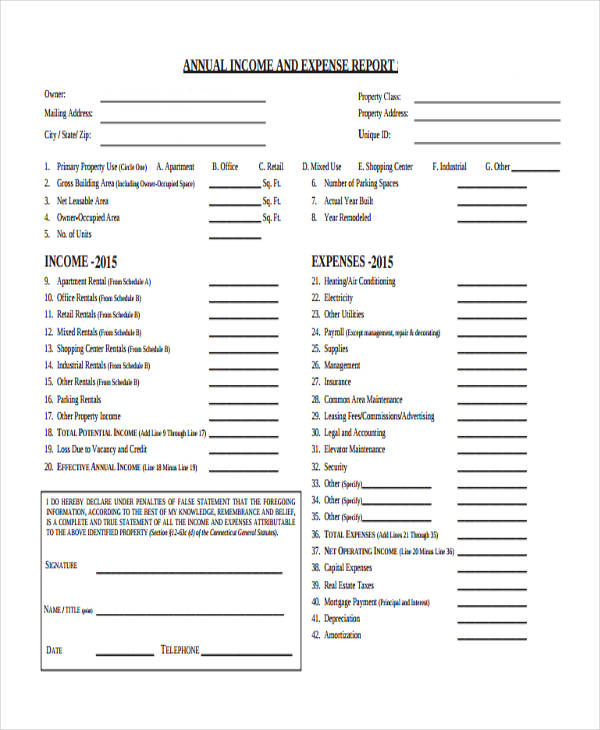

Ad Compare Best Mortgage Lenders 2023. Mortgages are how most people are. Web This includes your principal interest real estate taxes hazard insurance association dues or fees and principal mortgage insurance PMI.

Buy To Let Mortgage Post Office Money

Percentage Of Income For Mortgage Payments Quicken Loans

Home Affordability Calculator 28 36 Rule Calculator Academy

Home Affordability Calculator 28 36 Rule Calculator Academy

Solved Course Hero

Simple Taxable Income And Tax Calculator Insurance Funda

How Much House Can You Afford The 28 36 Rule Will Help You Decide

How To Calculate The 28 And 36 Monthly Housing Ratios Bryant University Financial Planning Education Blog

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Gary Basin Garybasin Twitter

Percentage Of Income For Mortgage Rocket Mortgage

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Free 28 Expense Report Forms In Pdf

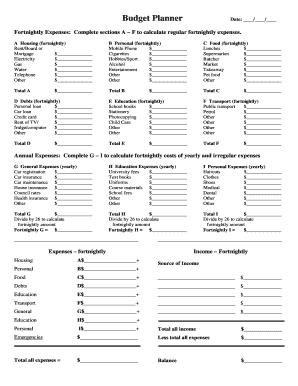

28 Free Editable Weekly Budget Templates In Ms Word Doc Page 2 Pdffiller

Pdf Minimum Income Schemes In Europe A Study Of National Policies

10 Zero Down Payment Mortgage Templates In Pdf Doc

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator